The Goods and Services Tax is a major indirect tax reform introduced in India from 01st July 2017 by amalgamating a large number of Central & State taxes into a single tax. The journey of GST in India started in the year 2000, then in the year 2016 it became the Constitution (101stAmendment) Act 2017.

In the following year 2017, Central Goods and Service Tax Bill 2017(CGST), Integrated Goods and Service tax Bill 2017(IGST), Union Territory Goods and Service Tax bill 2017(UTGST), Goods and Service (Compensation to States) Bill 2017 were Introduced and Passed in Lok Sabha. The enactment of the Central Acts was followed by the enactment of the state GST laws by various state Legislatures. In 1st July 2017 GST Launched in India

GST is a dual levy wherein both the Centre and State levy CGST and SGST simultaneously on the value of intra State supply.

Integrated Goods and Service Tax IGST is levied by Centre in the case of inter-State supplies including imports and exports.

Input tax credit can be availed even on goods and services received from other States.

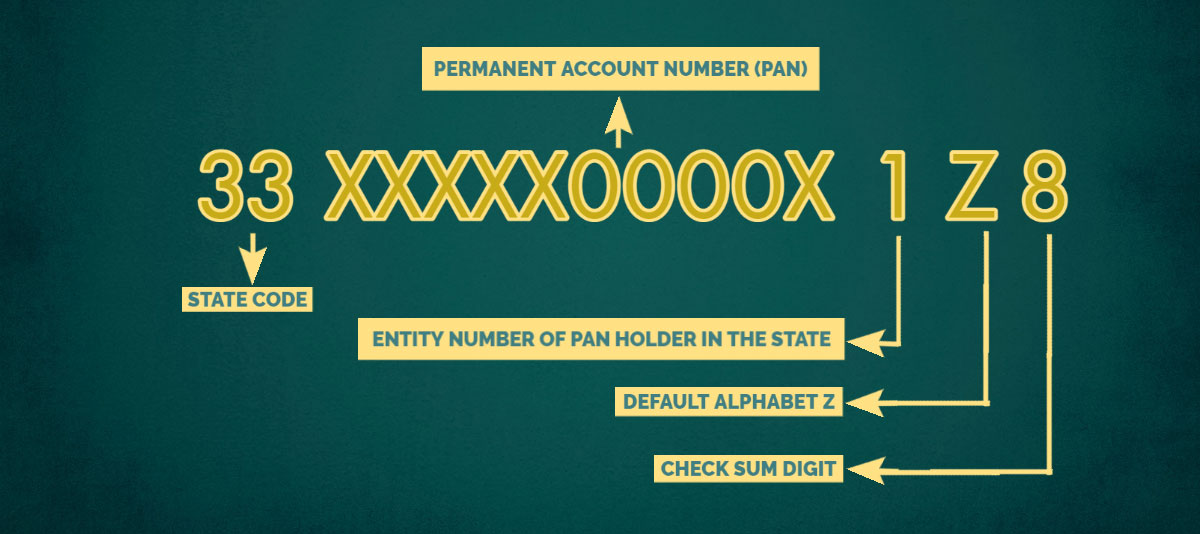

Goods and Service Taxpayer Identification Number(GSTIN) is a PAN based 15-digit number assigned to taxpayers registered under GST

The Registration under GST is Mandatory for the business entity based on the turnover or activities. The Aggregate Turnover for the financial year exceeds Rs.40 Lakhs and Rs.20 Lakhs business dealing with goods and services, however for business in Special category States, the turnover limit is Rs.20 lakhs and Rs.10 lakhs, everyone can register on Voluntary Basis under GST

The Registration under GST is Mandatory for the business entity based on the turnover or activities. The Aggregate Turnover for the financial year exceeds Rs.40 Lakhs and Rs.20 Lakhs business dealing with goods and services, however for business in Special category States, the turnover limit is Rs.20 lakhs and Rs.10 lakhs, everyone can register on Voluntary Basis under GST

Non filling of GST Return attracts Penalty and Interest, for delay filling of return, the taxpayer is charged with late fee of Rs.50 for each day of the delay till the actual day of filling the return. To avoid such heavy penalties, the return must be filled within the prescribed time limit. The Taxpayer with no tax liability has to file the return to avoid the late fee of Rs.20 for each day of delay till the date of filling. Interest at rate of 18% p.a. is payable on the Outstanding tax liability